Bitcoin price over time

Bitcoin has been a popular topic of discussion for investors and financial experts due to its volatile price movements over time. To better understand the factors influencing the price of Bitcoin, it is essential to explore different perspectives and analyses from reputable sources. Below is a list of four articles that delve into the topic of Bitcoin price over time, offering insights and information that can help readers navigate the cryptocurrency market with more confidence and knowledge.

Bitcoin has been a popular topic of discussion for investors and financial experts due to its volatile price movements over time. To better understand the factors influencing the price of Bitcoin, it is essential to explore different perspectives and analyses from reputable sources. Below is a list of four articles that delve into the topic of Bitcoin price over time, offering insights and information that can help readers navigate the cryptocurrency market with more confidence and knowledge.

Analyzing the Historical Trends of Bitcoin Prices: What Can We Learn?

In recent years, the world of cryptocurrency has been on a rollercoaster ride, with Bitcoin leading the charge as the most popular and valuable digital currency. As investors and analysts alike try to make sense of the unpredictable nature of Bitcoin prices, a new study has shed light on the historical trends that may provide some valuable insights.

The study, titled "Analyzing the Historical Trends of Bitcoin Prices: What Can We Learn?", delves into the past performance of Bitcoin prices and identifies key patterns that have emerged over time. By examining data from the inception of Bitcoin to the present day, the researchers were able to pinpoint recurring trends that could potentially help investors make more informed decisions.

One of the most significant findings of the study is the correlation between external events and Bitcoin price movements. For example, major regulatory announcements or market developments often coincide with sharp fluctuations in Bitcoin prices. By understanding these patterns, investors may be better equipped to anticipate future price movements and adjust their investment strategies accordingly.

Overall, this study serves as a valuable resource for anyone looking to gain a deeper understanding of the factors influencing Bitcoin prices. By analyzing historical trends and identifying key patterns, investors can make more informed decisions and navigate the volatile world of cryptocurrency with greater confidence.

The Impact of Market Sentiment on Bitcoin Price Fluctuations

Bitcoin has become a phenomenon in the world of finance, captivating investors and traders alike with its volatile price movements. One key factor that influences these price fluctuations is market sentiment. Market sentiment refers to the overall attitude of investors towards a particular asset, such as Bitcoin, and can have a significant impact on its price.

When market sentiment is positive, investors are optimistic about the future prospects of Bitcoin, leading to increased demand and higher prices. Conversely, when market sentiment is negative, investors may sell off their holdings, causing prices to fall. This dynamic relationship between sentiment and price is what drives the volatile nature of Bitcoin.

It is important for investors and traders to pay attention to market sentiment when making decisions about buying or selling Bitcoin. By understanding the prevailing sentiment in the market, they can better anticipate price movements and make informed decisions. For this reason, studying the impact of market sentiment on Bitcoin price fluctuations is crucial for anyone looking to navigate the world of cryptocurrencies successfully.

In conclusion, market sentiment plays a critical role in shaping the price of Bitcoin. By keeping a close eye on sentiment indicators and understanding how they influence price movements, investors can improve their chances of making profitable trades in the volatile cryptocurrency market.

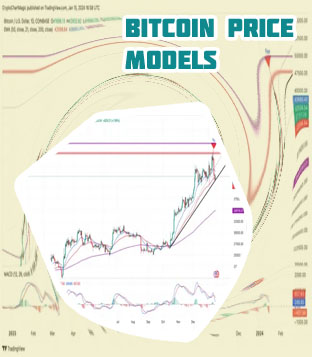

Predicting Bitcoin Price Movements Using Technical Analysis

As the world of cryptocurrency continues to evolve, many investors are turning to technical analysis as a way to predict Bitcoin price movements. Technical analysis involves studying past market data, primarily price and volume, to forecast future price trends. By utilizing various technical indicators and chart patterns, traders can make informed decisions about when to buy or sell Bitcoin.

One key indicator that technical analysts often use is the moving average. This indicator helps smooth out price data by creating a constantly updated average price over a specific time period. By analyzing the relationship between short-term and long-term moving averages, traders can identify potential trend reversals and price targets.

Another important tool in technical analysis is the Relative Strength Index (RSI). This indicator measures the speed and change of price movements and helps traders determine if Bitcoin is overbought or oversold. When the RSI reaches certain levels, it can signal potential buying or selling opportunities.

In addition to moving averages and RSI, traders also pay close attention to chart patterns such as head and shoulders, triangles, and flags. These patterns can provide valuable insight into potential price movements and help traders set profit targets and stop losses.

Overall, technical analysis can be a valuable tool for predicting Bitcoin price movements. By combining various indicators and chart patterns, traders can make more informed decisions

The Role of Institutional Investors in Shaping Bitcoin Price Trajectories

In the world of cryptocurrency, institutional investors play a crucial role in shaping the price trajectories of assets like Bitcoin. These large financial entities, such as hedge funds, pension funds, and insurance companies, have the power to influence market trends through their substantial investment decisions. Here are some key ways in which institutional investors impact the price of Bitcoin:

-

Market Liquidity: Institutional investors bring significant liquidity to the Bitcoin market, which can help stabilize prices and reduce volatility. Their large trades can also impact the overall supply and demand dynamics of the cryptocurrency.

-

Price Manipulation: Some critics argue that institutional investors have the potential to manipulate the price of Bitcoin through coordinated buying or selling activities. This can create artificial price movements that may not necessarily reflect the true value of the asset.

-

Market Sentiment: The entry of institutional investors into the Bitcoin market can also influence market sentiment. Positive news or endorsements from these entities can boost investor confidence and drive up prices, while negative sentiment can lead to sell-offs and price declines.

-

Regulatory Impact: Institutional investors are subject to regulatory oversight, and their actions can be influenced by changes in regulations governing cryptocurrency investments. This can have a direct impact on Bitcoin prices as these investors adjust their strategies to comply with new rules.

-

Long-Term